1. Use a Trading Plan

When it comes to trading, having a solid plan in place is crucial for success. A trading plan involves setting clear rules for entry, exit, and money management for each trade. These rules should be based on a deep understanding of the market and your risk tolerance. By having a trading plan, you can avoid making impulsive decisions and stick to a disciplined approach to trading.

One of the key elements of a trading plan is to set clear rules for entry and exit points for each trade. This helps to eliminate emotions from the decision-making process and ensures that trades are based on logical criteria rather than gut feelings. Additionally, having a plan for money management is essential to protect your capital and minimize losses.

It’s important to treat trading like a business, and having a trading plan is akin to having a business plan. Just as a business plan outlines the goals and strategies for a company, a trading plan outlines the goals and strategies for your trading activities.

By following a well-defined trading plan, you can increase your chances of success in the market. It helps you stay focused on your goals and avoid making emotional decisions that can lead to losses.

In conclusion, using a trading plan is essential for successful trading. It helps you make informed decisions based on logic rather than emotions, ultimately leading to more profitable trades. If you want to maximize your winnings in the market, start by creating a solid trading plan and sticking to it.

Read more about maximizing success in different areas with these Gambling success tips.

2. Treat Trading Like a Business

Trading is not a hobby; it’s a serious business endeavor that requires dedication and strategic planning. By treating trading like a business, you approach it with the same level of commitment, research, and strategizing as you would for any other business venture. This means dedicating full or part-time hours to learning and staying informed about market trends, news, and strategies.

Much like running a successful business, traders need to have a solid plan in place to guide their decision-making process. This includes setting clear financial goals, outlining risk tolerance, and establishing trading rules. By having a well-thought-out trading plan, you can minimize emotional decision-making and maximize the potential for profitability.

In addition to having a solid plan in place, it’s important to stay informed about market developments and changes. This means staying up-to-date with market trends, news, and strategies. Utilizing resources such as reputable financial publications, market analysis reports, and educational platforms can provide valuable insights that can inform your trading decisions.

Furthermore, backtesting your trading strategies is crucial for success. It allows you to assess the viability and potential success of your strategies based on historical data. This can help fine-tune your approach and optimize your trading plan for better results.

Lastly, leveraging technology can streamline the trading process and provide valuable tools for analysis and execution. Utilizing trading platforms, analytical tools, and automated trading systems can enhance efficiency and effectiveness in your trading operations.

By treating trading like a business and implementing these key strategies, you can position yourself for success in the competitive world of trading.

For more information on maximizing your earnings in crypto, check out Optimizing crypto earnings.

3. Stay Informed

Staying informed is crucial for successful trading. This means staying updated on market news, trends, and new trading strategies. By having a good understanding of the market, you can make more informed decisions and increase your chances of success in trading.

One way to stay informed is by regularly reading financial news websites, such as Bloomberg or CNBC, to keep up with current events that could impact the markets. Additionally, following influential traders and analysts on social media platforms like Twitter can provide valuable insights and perspectives.

Another great way to stay informed is by networking with other traders and joining online trading communities. These forums provide opportunities to learn from others, share strategies, and stay updated on the latest market developments.

Furthermore, it’s essential to educate yourself on different trading strategies. There are numerous resources available online, such as Earn money trading tips, that offer valuable information on various trading techniques and approaches. By continuously expanding your knowledge base, you can adapt to changing market conditions and improve your trading skills.

In conclusion, staying informed is a critical component of successful trading. By staying up-to-date on market news, trends, and new trading strategies, you can make more informed decisions and increase your chances of success in the trading world.

(250 words)

4. Backtesting

Backtesting is a vital step in trading. By testing your trading ideas using historical data, you can determine if your strategies are viable before risking real money. This allows you to refine and improve your trading strategies and minimize potential losses.

When backtesting, it’s essential to use accurate and reliable historical data to ensure the validity of your results. There are various software and tools available that can help with backtesting, allowing you to analyze your trading strategies and make informed decisions.

By backtesting your trading ideas, you can gain valuable insights into the performance of your strategies under different market conditions. This can help you identify any potential weaknesses or flaws in your approach and make the necessary adjustments to improve your overall trading performance.

Additionally, backtesting allows you to gain confidence in your trading strategies before implementing them in real-time trading. This can help you avoid impulsive and emotional decisions based on hypothetical scenarios and instead rely on proven historical data to guide your trading decisions.

In conclusion, backtesting is a crucial step in maximizing profits through trading strategies. It enables traders to refine their approaches, minimize potential losses, and make informed decisions based on historical data. By incorporating backtesting into your trading plan, you can significantly increase your chances of success in the financial markets.

To learn more about maximizing profits through strategic approaches, check out our article on Earning enhancement approaches.

5. Use Technology

In today’s fast-paced trading environment, technology plays a crucial role in maximizing profits and staying ahead of the curve. By leveraging technology, traders can gain valuable insights, monitor trades, and make informed decisions.

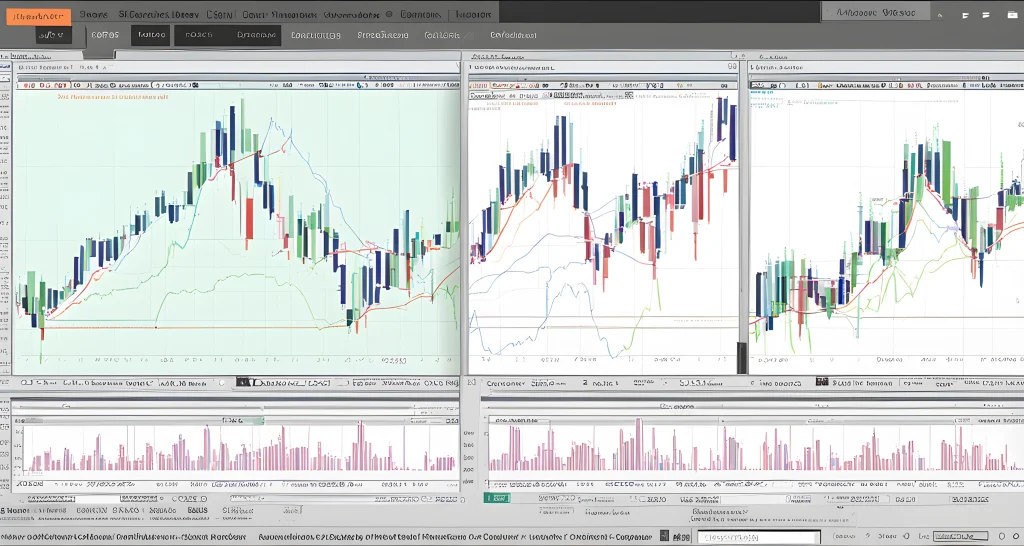

Charting Platforms

Charting platforms provide real-time data and analysis, allowing traders to visualize market trends and patterns. These platforms offer a variety of technical indicators and drawing tools to help traders identify potential entry and exit points for their trades. Utilizing charting platforms can help traders make more accurate predictions and improve their overall trading strategy.

Backtesting Tools

Backtesting tools allow traders to test their trading strategies using historical market data. By analyzing how a strategy would have performed in the past, traders can gain a better understanding of its potential effectiveness in different market conditions. This can help traders fine-tune their strategies and optimize their trading approach for maximum profitability.

Market Updates

Staying informed about market developments is essential for successful trading. Technology provides access to real-time market updates, news, and analysis, enabling traders to stay on top of current trends and events that may impact their trades. By staying informed, traders can make more educated decisions and adapt their strategies to changing market conditions.

By incorporating these technological tools into their trading approach, traders can enhance their overall trading experience and increase their chances of success. To learn more about boosting cryptocurrency profits through strategic trading, check out our article on Boosting Cryptocurrency Profits.

FAQ

What is a trading plan?

A trading plan is a set of rules that specifies a trader’s entry, exit, and money management criteria for every purchase. it is based on a thorough understanding of the market and the trader’s risk tolerance.

How should i approach trading?

Approach trading as a full or part-time business, not as a hobby or a job. this requires commitment to learning, research, and strategizing to maximize your business’s potential.

Why is knowledge important in trading?

Knowledge is crucial in trading as it enables you to stay updated on market news, trends, and strategies, allowing you to make informed decisions.

What is backtesting?

Backtesting involves testing your trading ideas using historical data before risking real money. this allows you to determine if your strategies are viable.

How can i utilize technology in trading?

Take advantage of charting platforms, backtesting tools, and market updates to monitor trades and make informed decisions.

What are realistic expectations in trading?

Understand that not all trades will be profitable and that losses are a part of trading. aim for a strategy that profits more on winners than it loses on losers.